- Taxpayer information

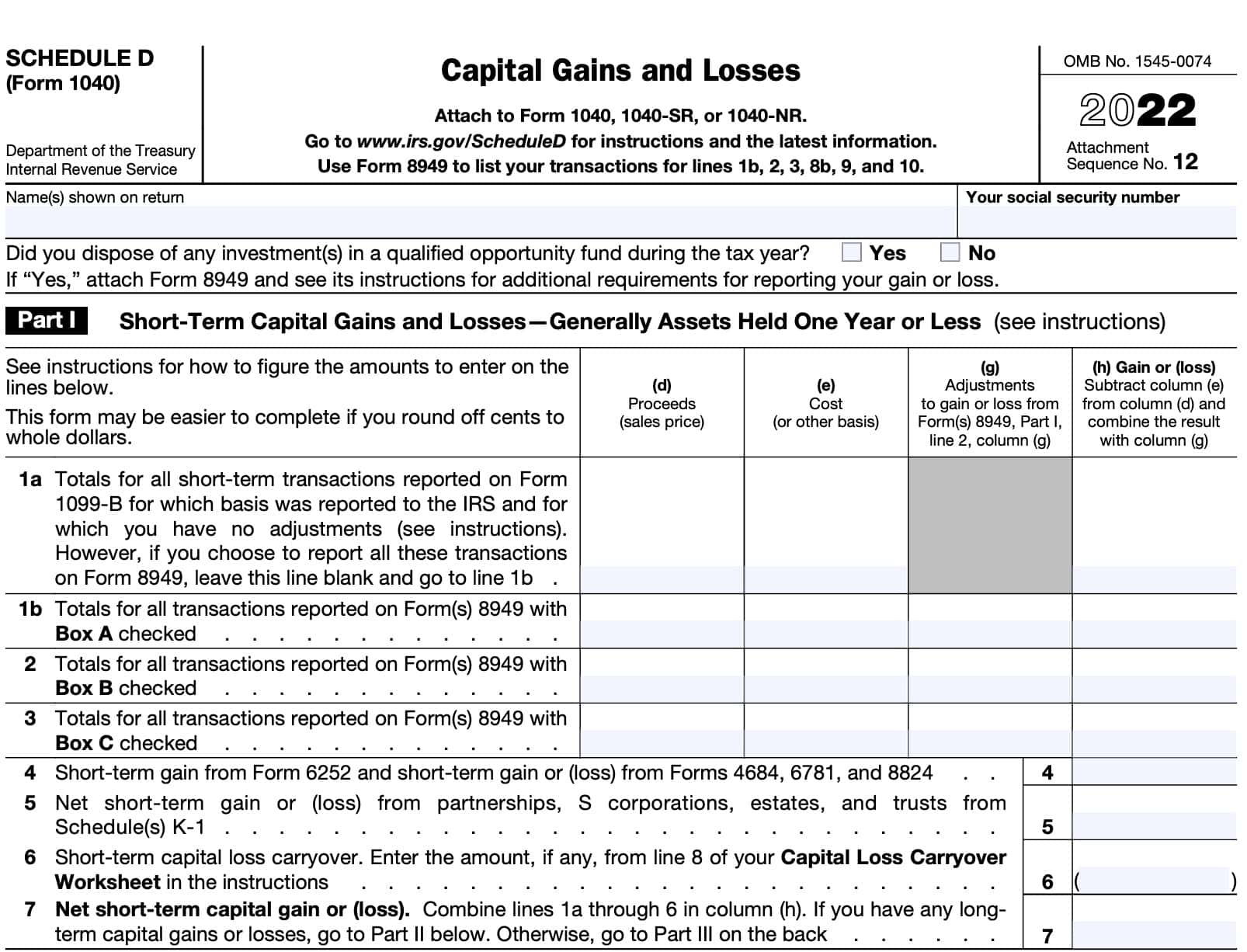

- Part I: Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less

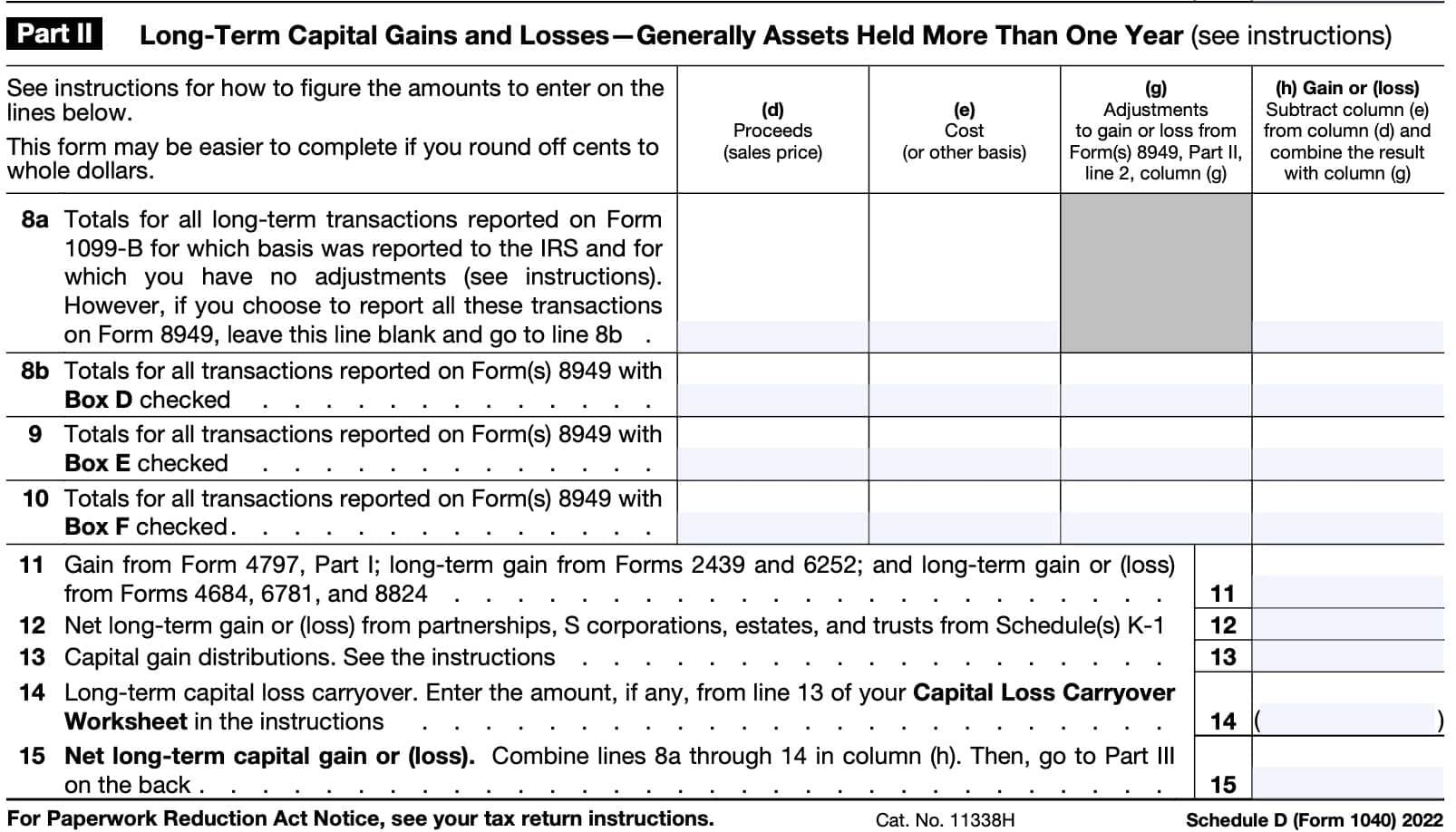

- Part II: Long-Term Capital Gains and Losses—Generally Assets Held More Than One Year

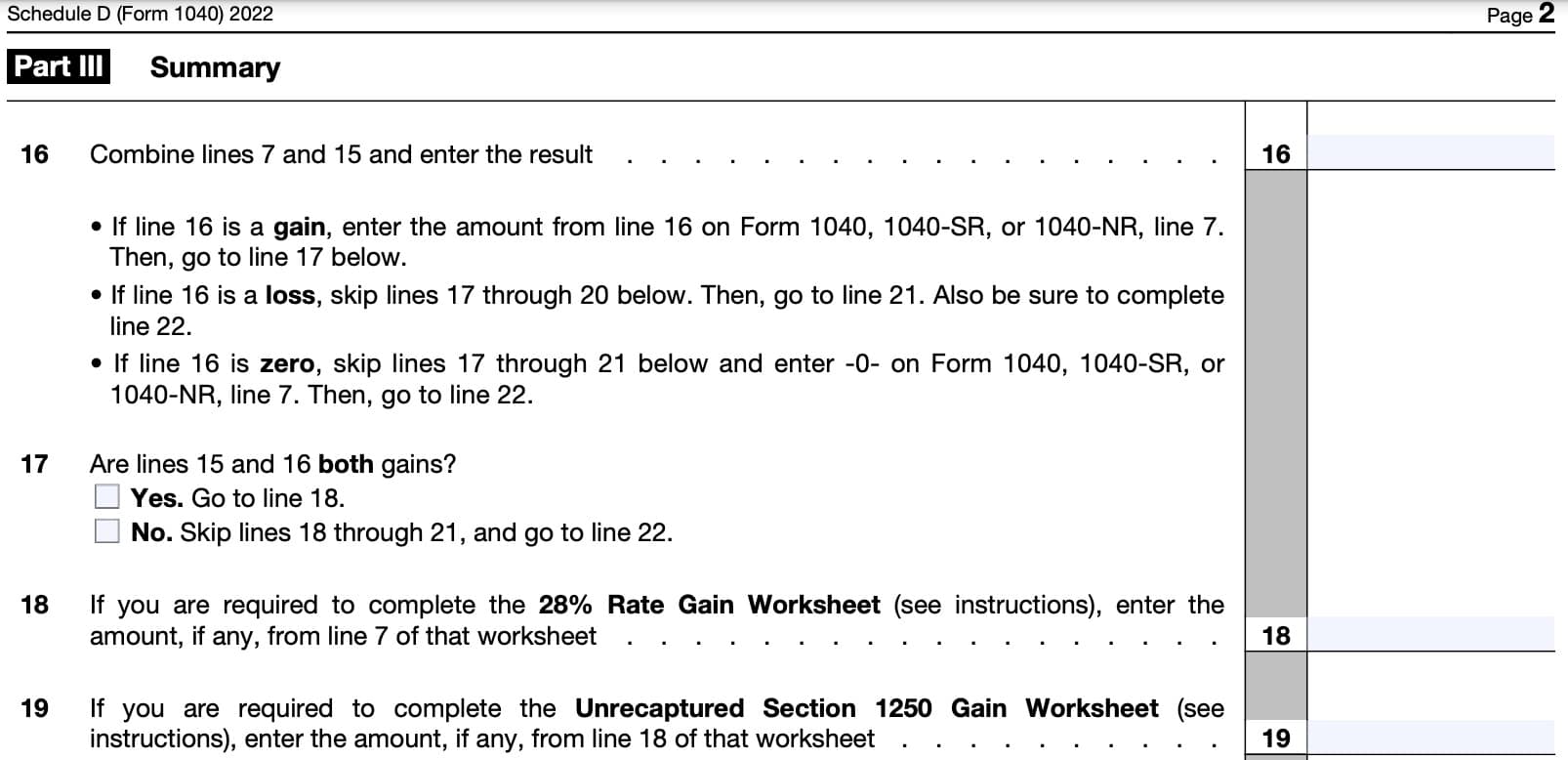

- Part III: Summary

How do I complete IRS Schedule D?

There are three parts to this two-page tax form:

- Part I: Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less

- Part II: Long-Term Capital Gains and Losses—Generally Assets Held More Than One Year

- Part III: Summary

Let’s start at the top of the form, just above Part I.

Taxpayer information

First, enter the taxpayer name and Social Security number as shown on the rest of your federal income tax return.

Just after the taxpayer name field, you’ll see a question about investing in a qualified opportunity fund during the tax year.

Qualified opportunity fund

A qualified opportunity fund (QOF) is any investment vehicle that is organized as either a corporation or partnership for the purpose of investing in eligible property that is located in a qualified opportunity zone.

If you have an eligible gain, you can invest that gain in a QOF. This allows you to defer part or all of the gain that you would otherwise include in income until the earlier of:

- The date that you sell or exchange your QOF investment, or

- December 31, 2026

If you make the election, you only include gain to the extent, if any, the amount of realized gain is more than the aggregate amount invested in a QOF during the 180-day period beginning on the date the gain was realized.

You may also be able to permanently exclude the gain from the sale or exchange of any investment in a QOF if the investment is held for at least 10 years.

If you did dispose of a QOF investment during the year, check ‘Yes’ and attach your completed IRS Form 8949, Sales and Other Dispositions of Capital Assets, to your tax return. The IRS Form 8949 instructions contain additional reporting requirements.

Let’s take a closer look at Part I of this Schedule D form.

Part I: Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less

In Part I, we will document and capture short term capital gains and losses. Before we start, let’s discuss the difference between short term capital treatment and long term capital treatment/

Tax differences between short term and long term transactions

Short term transactions are transactions in which the holding period for the capital asset is one year or less. Short term capital gains and losses are subject to the same tax treatment as ordinary income.

Long term transactions are transactions in which the holding period for the capital asset is more than one year. Long term capital gains are subject to preferential tax treatment, known as capital gains treatment.

The tax rates for ordinary income range between 0% and 37%. Capital gains tax treatment ranges between 0% and 20%, depending on the taxpayer’s tax bracket.

Line 1a

For Lines 1a through 3, you may need to enter the following information in each applicable column:

- Column (d), Proceeds or sales price:

- Column (e), Cost basis or other basis:

- Column (g), Adjustments to losses or gains from IRS Form 8949, Line 2, Column (g)

- Column (h), Gain or loss

- Calculate the gain or loss in each line by subtracting Column (e) from Column (d), then combining that result with the adjustment in Column (g)

In Line 1a, enter the total amount for all short-term transactions that you did not otherwise record on IRS Form 8949, as long as:

- You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn’t show any adjustments in Box 1f (Accrued market discount) or 1g (wash sale loss disallowed);

- The Ordinary box in Box 2 isn’t checked;

- The QOF box in Box 3 isn’t checked;

- You are not electing to defer income due to an investment in a QOF and aren’t terminating deferral from an investment in a QOF; and

- You don’t need to make any adjustments to the basis or type of gain or loss reported on Form 1099-B (or substitute statement), or to your gain or loss.

If you report transactions on Line 1a, use Form 8949 to report them. If sales of capital assets were reported on IRS Form 8949, do not report them on Line 1a.

Below are several examples of how to report specific transactions.

Example 1: basis Was reported to the IRS.

You received a Form 1099-B reporting the sale of stock you held for 6 months. The form shows the following information:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is checked (Basis reported to IRS)

You do not need to make any adjustments or enter any codes. Instead of reporting this transaction on IRS Form 8949, you can simply report it on Line 1a as follows:

- Column (d): $6,000

- Column (e): $2,000

- Column (h): $4,000

Example 2: basis not reported to the IRS

You received a Form 1099-B showing the following information for a stock that you held for 6 months:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is not checked (Basis not reported to IRS)

Don’t report this transaction on Line 1a. Instead, report the transaction on IRS Form 8949. Complete all necessary pages of Form 8949 before completing any other lines in IRS Schedule D.

Example 3: adjustment

You received a Form 1099-B showing the following information about a stock that you’ve held for 6 months:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is checked (Basis reported to IRS)

However, the reported basis is incorrect.

Don’t report this transaction on Line 1a. Instead, report the transaction on IRS Form 8949. Complete all necessary pages of Form 8949 before completing any other lines in IRS Schedule D.

Line 1b: Total for all transactions reported on Form 8949 with Box A checked

In Line 1b, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box A checked.

Box A indicates short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS.

Line 2: Total for all transactions reported on Form 8949 with Box B checked

In Line 2, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box B checked.

Box B indicates short-term transactions reported on Form(s) 1099-B showing basis was not reported to the IRS.

Line 3: Total for all transactions reported on Form 8949 with Box C checked

In Line 3, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box C checked.

This indicates short-term transactions that were not reported on Form(s) 1099-B.

Line 4

In Line 4, you’ll need to total the following, as applicable:

- Short-term gain from IRS Form 6252, Installment Sale Income

- Short-term gains or losses from casualties and thefts, reported on IRS Form 4684

- Short-term gains or losses from Section 1256 contracts and straddles, on IRS Form 6781

- Short-term gains or losses from like-kind exchanges, as reported on IRS Form 8824

Enter the total in the box on Line 4.

Line 5

In Line 5, enter any short-term gain or loss as reported on Schedule K-1 from any of the following:

- Partnerships

- S corporations

- Estates

- Trusts

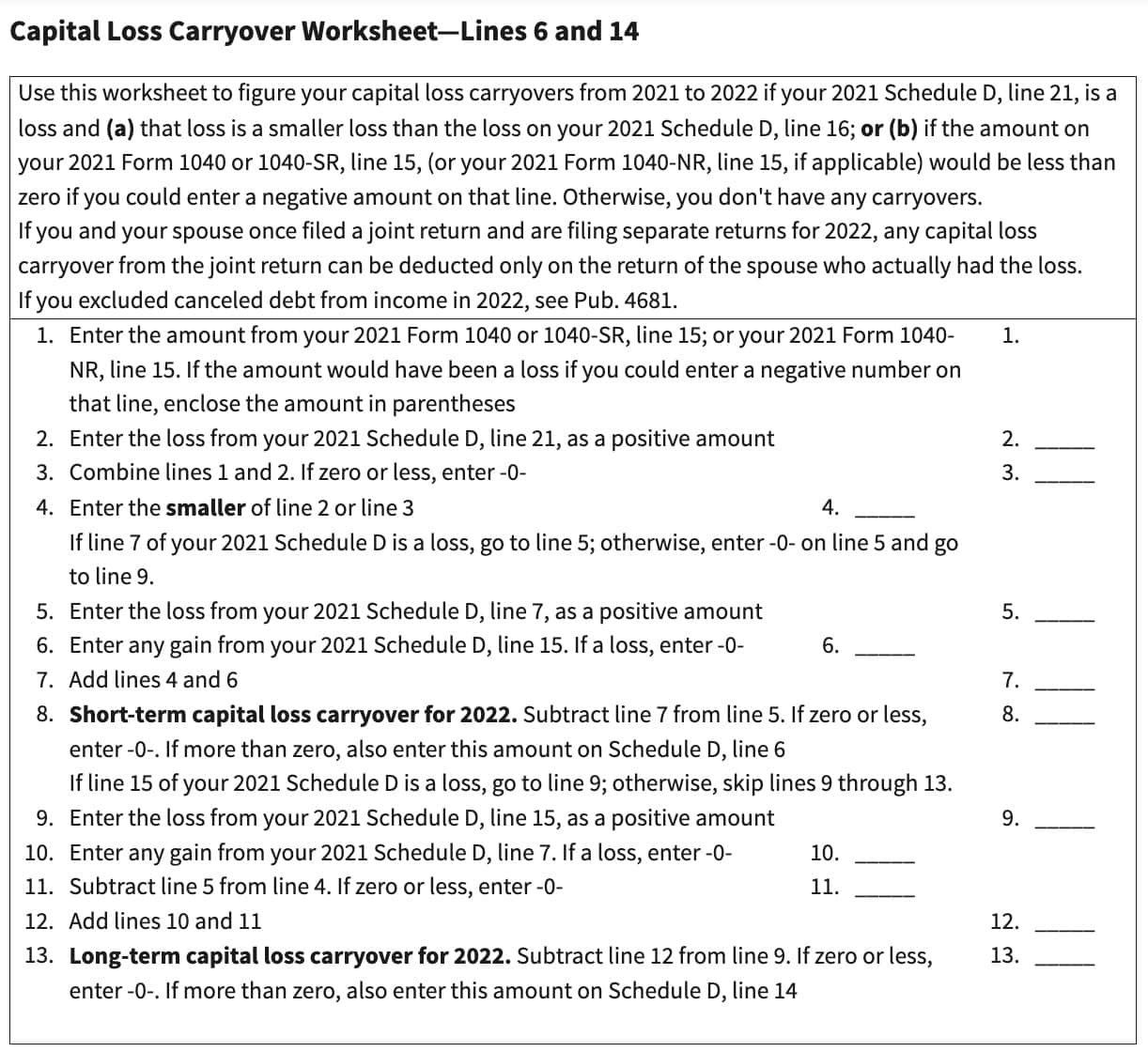

Line 6: Short-term capital loss carryover

Complete the capital loss carryover worksheet, as shown below. Enter any short-term capital losses carried over from the previous tax year, as shown on Line 8 of the worksheet.

Watch this video to walk through the capital loss carryover worksheet in depth!

Line 7: Net short-term capital gain (or loss)

Combine Lines 1a through 6, above. Enter the result in Line 7.

If you have long-term capital gains or losses, then proceed to Part II. Otherwise, go to the Summary section in Part III.

Part II: Long-Term Capital Gains and Losses—Generally Assets Held More Than One Year

In Part II, we’ll capture long-term transactions in a very similar fashion as we did for short-term transactions in Part I. We will also include capital gain distributions, which generally receive preferential tax treatment at capital tax rates.

As a reminder, long-term capital gains treatment only applies to assets with a holding period of more than one year. The easy way to remember this is to remember that the holding period should be at least 1 year PLUS 1 day.

Line 8a

For Lines 8a through 10, you may need to enter the following information, as in Part I, in each applicable column:

- Column (d), Proceeds:

- Column (e), Cost or other basis:

- Column (g), Adjustments to losses or gains from IRS Form 8949, Line 2, Column (g)

- Column (h), Gain or loss

- Calculate the gain or loss in each line by subtracting Column (e) from Column (d), then combining that result with the adjustment in Column (g)

In Line 8a, enter the total amount for all long-term transactions that you did not otherwise record on IRS Form 8949, as long as:

- You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn’t show any adjustments in Box 1f or 1g

- The Ordinary box in Box 2 isn’t checked;

- The QOF box in Box 3 isn’t checked;

- You are not electing to defer income due to an investment in a QOF and aren’t terminating deferral from an investment in a QOF; and

- You don’t need to make any adjustments to the basis or type of gain or loss reported on Form 1099-B (or substitute statement), or to your gain or loss.

As with short-term transactions, if you report transactions on Line 8a, do not report them on Form 8949. Conversely, if sales of capital assets were reported on IRS Form 8949, do not report them on Line 1a.

As in Part I, below are several examples of how to report specific transactions that qualify for long-term treatment. For your convenience, these examples are exactly identical to those in Part I, except that the 6 month holding period has been replaced by an 18 month holding period.

Example 1: basis Was reported to the IRS.

You received a Form 1099-B reporting the sale of stock you held for 18 months. The form shows the following information:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is checked (Basis reported to IRS)

You do not need to make any adjustments or enter any codes. Instead of reporting this transaction on IRS Form 8949, you can simply report it on Line 1a as follows:

- Column (d): $6,000

- Column (e): $2,000

- Column (h): $4,000

Example 2: basis not reported to the IRS

You received a Form 1099-B showing the following information for a stock that you held for 18 months:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is not checked (Basis not reported to IRS)

Don’t report this transaction on Line 8a. Instead, report the transaction on IRS Form 8949. Complete all necessary pages of Form 8949 before completing any other lines in IRS Schedule D.

Example 3: adjustment

You received a Form 1099-B showing the following information about a stock that you’ve held for 18 months:

- Box 1d (Proceeds): $6,000

- Box 1e (Cost or other basis): $2,000

- Box 3 is checked (Basis reported to IRS)

However, the reported basis is incorrect.

Don’t report this transaction on Line 8a. Instead, report the transaction on IRS Form 8949. Complete all necessary pages of Form 8949 before completing any other lines in IRS Schedule D.

Line 8b

In Line 8b, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box D checked.

Box D indicates long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS.

Line 9

In Line 9, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box E checked.

Box E indicates long-term transactions reported on Form(s) 1099-B showing basis was not reported to the IRS.

Line 10

In Line 10, enter the total proceeds, basis, adjustments, and gains or losses from IRS Form 8949 with Box F checked.

This indicates long-term transactions that were not reported on Form(s) 1099-B.

Line 11

In Line 11, enter the following:

- Overall gain from IRS Form 4797, Part I

- Undistributed long-term capital gains from IRS Form 2439

- Long-term gain from installment sales as reported on IRS Form 6252, Installment Sale Income

- Long-term gains or losses from casualties and thefts, reported on IRS Form 4684

- Long-term gains or losses from Section 1256 contracts and straddles, on IRS Form 6781

- Long-term gains or losses from like-kind exchanges, as reported on IRS Form 8824

Line 12

In Line 12, enter any long-term gain or loss from partnerships, S-corporations, estates, and trusts, as reported on Schedule K-1.

Line 13: Capital gain distributions

Capital gain distributions are paid from net realized long-term capital gains by one of the following:

- Mutual fund

- Regulated investment company

- Real estate investment trust (REIT)

Only long-term capital gains are paid as capital gain distributions.

Distributions of net realized short-term capital gains aren’t treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary dividends.

On Line 13, enter the total capital gain distributions paid to you during the current tax year, regardless of how long you held the investment. You will see capital gain distributions in Box 2a of Form 1099-DIV.

Reporting other capital gain distributions

On your Form 1099-DIV, you may see other capital gain distributions. Do not report these on Line 13. Instead, you may need to report them elsewhere on Schedule D.

Unrecaptured Section 1250 Gain

If there is an amount in Box 2b, you may need to complete Line 19, below. If applicable, include that amount on Line 11 of the Unrecaptured Section 1250 Gain Worksheet to complete Line 19.

Section 1202 Gain

Under Internal Revenue Code Section 1202, certain small business owners may be able to exclude some or all of the capital gain on the sale of qualified small business stock (QSB stock).

If you received a Form 1099-DIV with a gain in Box 2c, then part or all of that gain may be eligible for the section 1202 exclusion. The Box 2c amount is also included in the Box 2a amount (total gain).

Report the total gain from Box 2a, then follow the instructions for reporting the transaction in Part II of Form 8949.

Collectibles Gain

The Internal Revenue Service applies a separate tax rate of 28% to the sale of collectibles.

If there is an amount in Box 2d on Form 1099-DIV, you may need to complete Line 18, below. If applicable, include that amount on Line 4 of the 28% Rate Gain Worksheet.

Line 14: Long-term Capital loss carryover

Using the same capital loss carryover worksheet as in Part I, calculate any long-term capital loss carryover from a prior tax year.

If applicable, enter the amount from Lien 13 of the capital loss carryover worksheet into Line 14.

Line 15: Net long-term capital gain (or loss)

Combine Lines 8a through 14, above. Enter the result in Line 15.

Proceed to the Summary section in Part III.

Part III: Summary

In Part III, we will net capital gains and losses in order to arrive at a final gain or loss. We’ll also perform a tax computation on various types of capital gains to determine overall tax liability.

Line 16

Combine the amounts from Line 7 and Line 15, above. These are the short-term and long-term capital gains (or losses) from Part I and Part II.

Enter the result into Line 16.

If the result is a gain

Also enter the amount on Line 7 of any of the following, depending on your tax situation:

- IRS Form 1040

- IRS Form 1040-SR

- IRS Form 1040-NR

Afterwards, proceed to Line 17.

If the result is a loss

Skip Lines 17 through 20, then proceed to Line 21. Additionally, you’ll need to complete Line 22 to report any qualified dividends you may have received during the tax year.

If the result is exactly zero

Skip Lines 17 through 21. Enter ‘0’ on Line 7 of your Form 1040, Form 1040-SR, or Form 1040-NR.

Line 17: Are Lines 15 and 16 both gains

If you reported both a long-term capital gain in Line 15, and an overall capital gain in Line 16, then go to Line 18, below.

Otherwise, skip Lines 18 through 21, and go to Line 22.

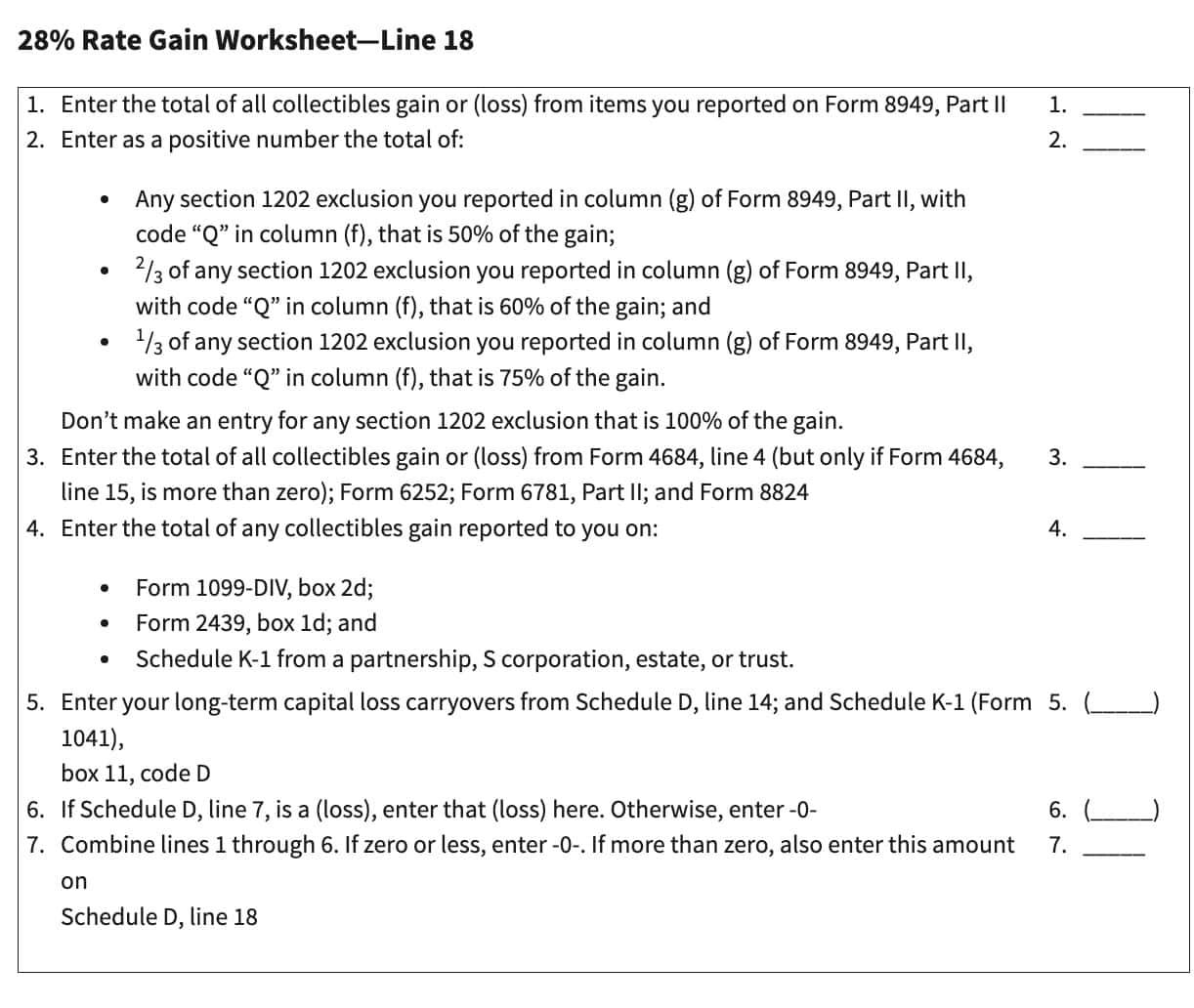

Line 18: 28% gain worksheet

You’ll need to complete the 28% Gain Worksheet, located below if you checked ‘Yes” in Line 17, and you reported either of the following in Part II on IRS Form 8949:

- Section 1202 exclusion from the eligible gain on QSB stock on IRS Form 8949, Part II

- Collectibles gain or (loss).

- A collectibles gain or (loss) is any long-term gain or deductible long-term loss from the sale or exchange of a collectible that is a capital asset

Enter the total in Line 18.

Check out our video for more in depth coverage on completing the 28% gain worksheet!

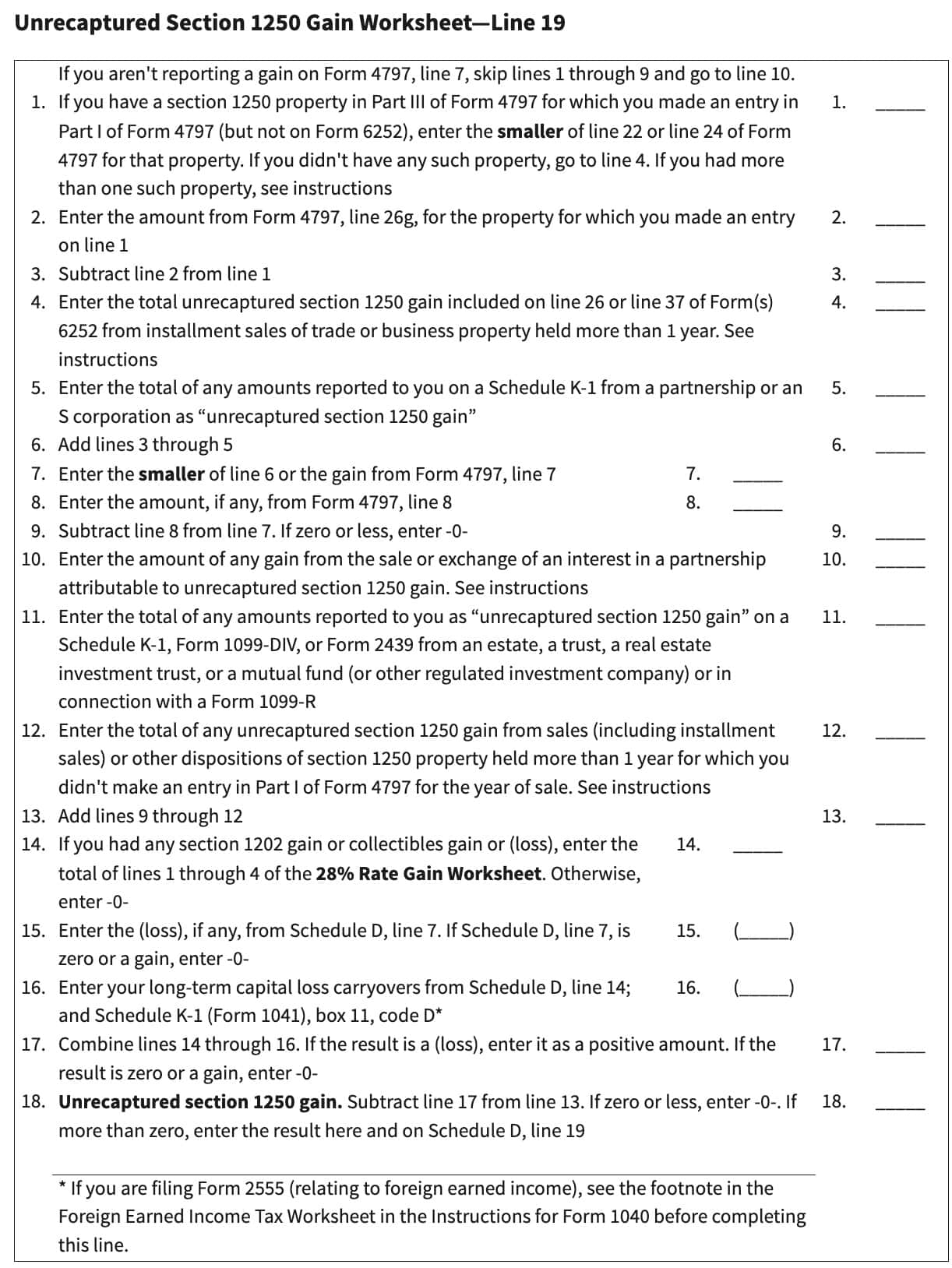

Line 19: Unrecaptured Section 1250 Gain

You’ll need to complete the Unrecaptured Section 1250 Gain Worksheet, located below if you checked ‘Yes” in Line 17, and any of the following applies:

Section 1250 property is generally real property depreciated by the taxpayer over time.

- You sold or otherwise disposed of Section 1250 property held more than 1 year

- You received installment payments for Section 1250 property held more than 1 year for which you are reporting gain on the installment method.

- You received a Schedule K-1 from an estate or trust, a partnership, or an S corporation that shows “unrecaptured section 1250 gain.”

- You received a Form 1099-DIV or Form 2439 from a real estate investment trust or regulated investment company (including a mutual fund) that reports “unrecaptured Section 1250 gain.”

- Form 1099-DIV: Box 2b

- Form 2439: Line 1b

Learn more about completing the unrecaptured Section 1250 gain worksheet by watching our video!

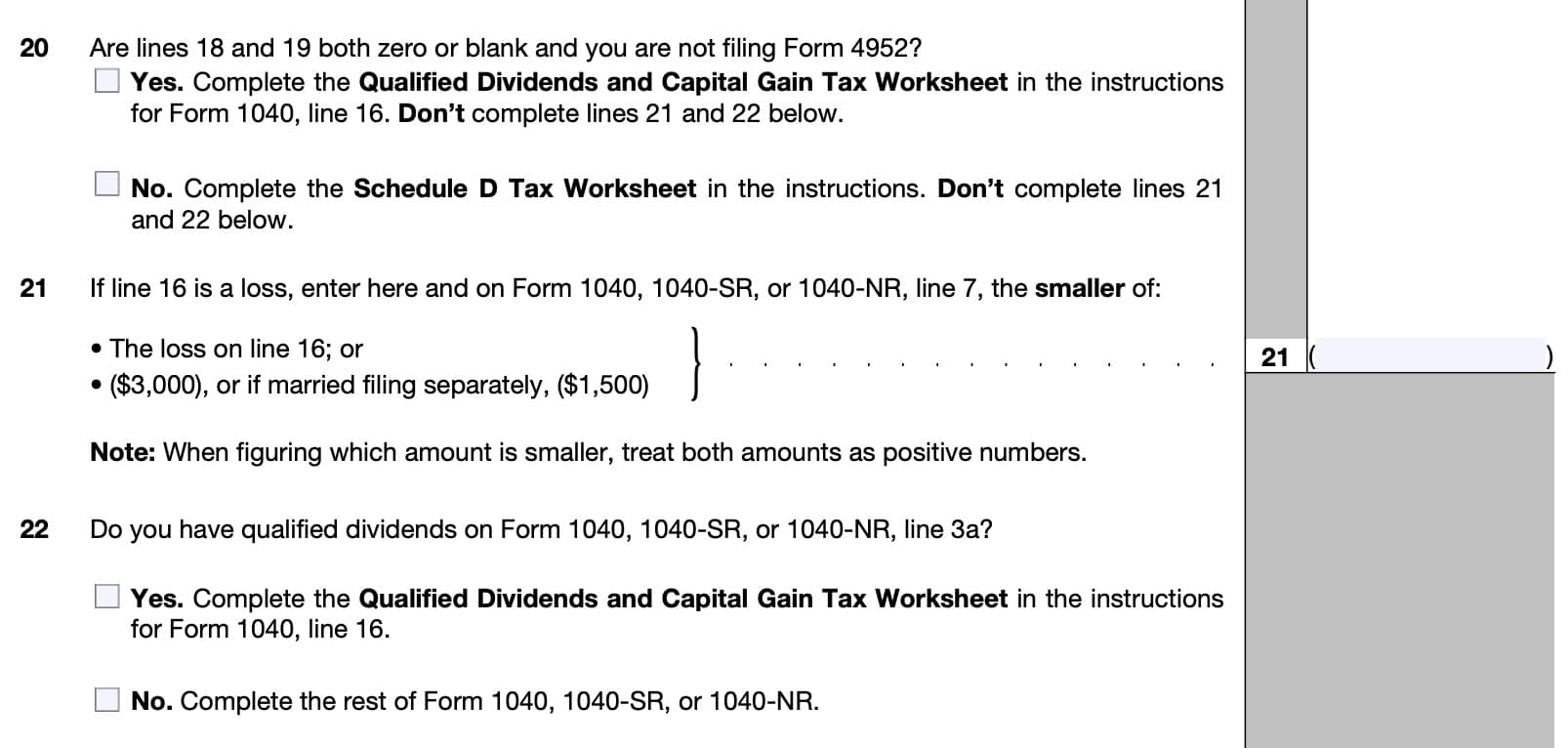

Line 20

Answer Yes or No to the following:

- Are both Line 18 and Line 19 zero or blank?

- Are you not claiming an investment interest expense deduction on IRS Form 4952?

If the answer is Yes, then do the following:

- Complete the Qualified Dividends and Capital Gain Tax Worksheet, located in the instructions for IRS Form 1040

- Do not complete Line 21 or Line 22, below

If the answer is no, then complete the Schedule D Tax Worksheet, located in the IRS Schedule D Instructions. For your convenience, we’ve covered the Schedule D Tax worksheet in depth in this video!

Line 21

If Line 16 is a loss, then enter the smaller of the following on Line 21 and on Line 7 of your respective individual tax return:

- The Line 16 loss

- $3,000

- $1,500 if your filing status is married filing separately

Line 22: Qualified dividends

Are you reporting qualified dividends on Line 3a of your tax return?

If so, complete the Qualified Dividends and Capital Gain Tax Worksheet located in the Form 1040 instructions. Otherwise, simply complete the rest of your tax return without filling out the worksheet.

Video walkthrough

Frequently asked questions

I just sold my primary house. Do I report my gain on IRS Schedule D?Generally, taxpayers are able to exclude up to $250,000 ($500,000 if married filing jointly) in capital gain from the sale of a primary residence that they’ve owned and lived in for 2 of the previous 5 years. You only need to report gains that you cannot exclude from taxable income.

How much in capital losses can I deduct from my tax return?Taxpayers generally are able to deduct up to $3,000 in capital losses against ordinary income. Any unused amount can be carried forward to a future tax year. However, there is generally no limit in the amount of capital losses a taxpayer may use to offset capital gains on Schedule D.

Where can I find IRS Schedule D?

You can find this tax form on the IRS website. For your convenience, we’ve included the latest version of IRS Schedule D in this article.